The Multi Time Frame (MTF) Chart Method is a powerful analytical framework that integrates signals across multiple temporal resolutions. For institutional traders, MTF analysis is not merely a visual enhancement—it’s a tactical tool for trend validation, entry precision, and risk calibration.

Introduction: Why MTF Matters

Markets are fractal in nature. Trends and reversals manifest differently across timeframes. Institutional traders must reconcile short-term execution with long-term positioning. MTF analysis bridges this gap by aligning microstructure signals with macro context.

MTF Concept and Calculation

MTF overlays indicators from higher timeframes (HTF) onto lower timeframe (LTF) charts. This allows traders to:

Confirm short-term setups within broader trends

Avoid counter-trend trades

Time entries with reduced noise

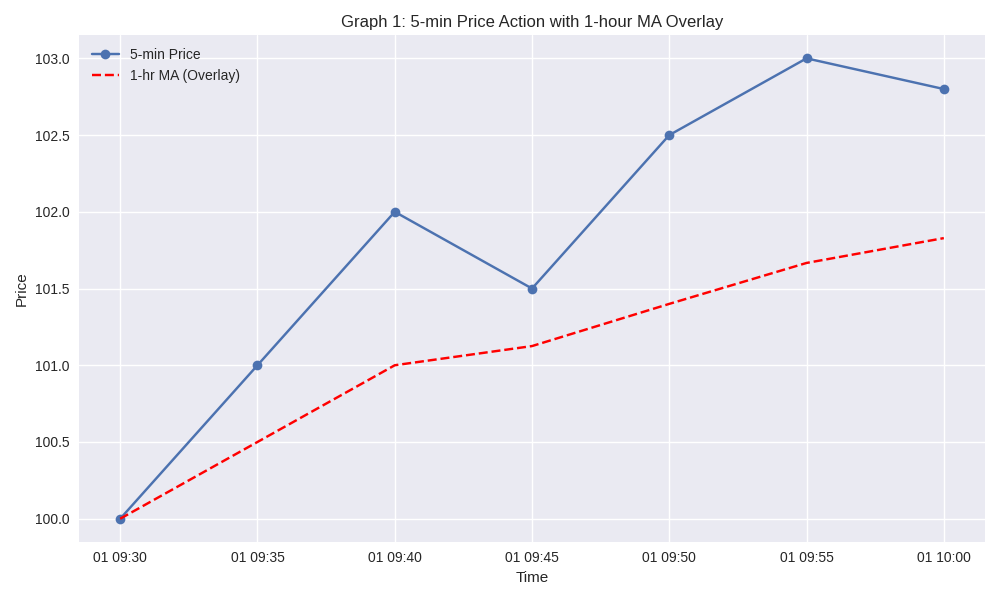

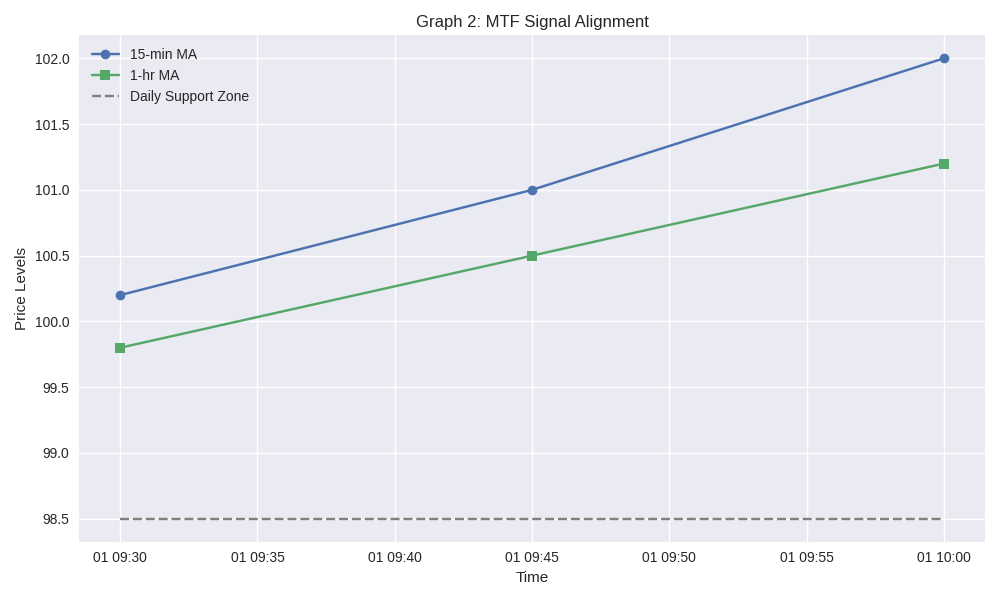

For example, overlaying a 1-hour moving average on a 5-minute chart provides directional bias. Similarly, combining 15-min momentum with daily support zones enhances conviction.

5-min Price Action with 1-hour MA Overlay

This chart illustrates how short-term price interacts with higher timeframe trend.

Click/open the card above to view the graph.

Institutional Use Cases

1. Trend Confirmation

Institutions avoid initiating trades against dominant HTF trends. MTF ensures:

5-min breakout aligns with 1-hour uptrend

15-min reversal occurs near daily support

2. Entry Timing

MTF helps refine entries:

Wait for 15-min bullish crossover within 1-hour uptrend

Use LTF pullbacks to enter HTF continuation

3. Risk Management

MTF zones define stop placement and sizing:

HTF support/resistance anchors risk

LTF volatility informs position sizing

MTF in Execution and Risk Management

Smart order execution algorithms incorporate MTF logic:

HTF filters: avoid trades during HTF consolidation

LTF triggers: execute only on LTF momentum confirmation

Dynamic risk: adjust stop-loss based on HTF volatility

Quant desks use MTF to model regime shifts and volatility clustering across timeframes.

MTF Signal Alignment

This chart shows a bullish alignment:

15-min MA crossover

1-hour trend confirmation

Daily support zone

Click/open the card above to view the graph.

Limitations and Considerations

Lag: HTF indicators may delay signal confirmation

Complexity: MTF increases cognitive and computational load

Overfitting risk: excessive MTF filters may reduce trade frequency

Conclusion

MTF analysis is indispensable for institutional traders seeking precision and context. By integrating signals across timeframes, MTF enhances trend fidelity, entry accuracy, and risk control. Whether embedded in execution algorithms or used in discretionary trading, MTF transforms fragmented data into coherent strategy.