The Volume-Weighted Average Price (VWAP) is more than a technical indicator—it’s a cornerstone of institutional execution strategy, liquidity assessment, and intraday market structure analysis. This article explores VWAP from a professional trader’s lens, detailing its calculation, strategic applications, and integration into algorithmic execution frameworks.

Introduction: VWAP as an Execution Benchmark

VWAP represents the average price of a security weighted by traded volume over a defined period, typically intraday. Unlike simple moving averages, VWAP incorporates both price and liquidity, making it a preferred benchmark for institutions aiming to minimize market impact and slippage. It’s especially relevant for:

Buy-side execution desks benchmarking trade quality

Sell-side algorithms optimizing order slicing

Quantitative traders modeling intraday price behavior

VWAP Calculation Methodology

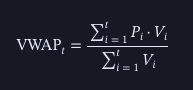

VWAP is calculated cumulatively throughout the trading session:

Where:

PiP_i = price at time interval ii

ViV_i = volume at time interval ii

This formula ensures that high-volume trades exert more influence on the average price, aligning with real liquidity dynamics.

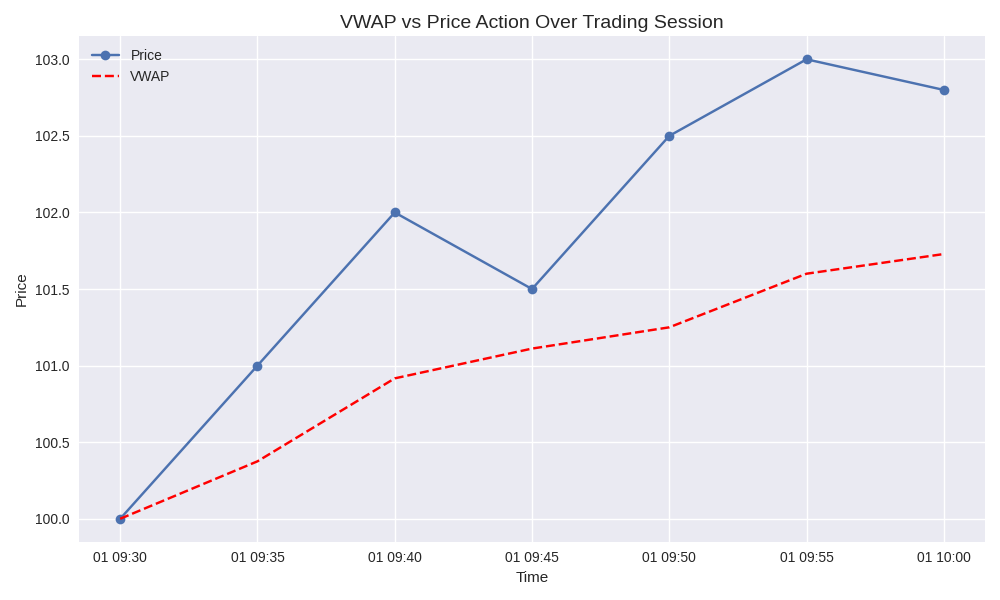

VWAP vs Price Action: Institutional Interpretation

The graph below illustrates VWAP versus price action over a simulated trading session. Institutional traders interpret deviations from VWAP as signals of liquidity imbalance or momentum:

Price > VWAP: bullish sentiment or aggressive buying

Price < VWAP: bearish sentiment or aggressive selling

Mean reversion to VWAP: common in passive execution strategies

Click/open the card above to download the graph.

Institutional Use Cases

1. Execution Quality Benchmarking

VWAP is used to evaluate whether trades were executed at favorable prices relative to market liquidity. For example:

A buy order executed below VWAP is considered efficient.

VWAP slippage metrics are tracked across brokers and algorithms.

2. Liquidity-Sensitive Order Slicing

Algorithms like TWAP, POV, and VWAP-based execution engines use VWAP as a reference to:

Minimize market impact

Avoid adverse selection

Align with liquidity curves

3. Intraday Mean Reversion Models

Quant desks use VWAP as a dynamic anchor for:

Identifying overbought/oversold conditions

Structuring statistical arbitrage trades

Enhancing signal-to-noise ratio in high-frequency strategies

VWAP in Algorithmic Execution

VWAP is embedded in smart order routers and execution algorithms:

Static VWAP: targets execution near the day’s VWAP

Dynamic VWAP: adjusts participation rate based on real-time volume

Arrival Price + VWAP hybrid: balances immediacy with price improvement

Advanced implementations integrate:

Real-time volume forecasting

Microstructure-aware slicing (e.g., avoiding auction spikes)

Adaptive logic based on slippage and fill rates

Limitations and Considerations

Not predictive: VWAP is descriptive, not forward-looking

Volume distortion: Large block trades can skew VWAP

Latency sensitivity: Real-time VWAP requires low-latency data feeds

Session dependency: VWAP resets daily; not suitable for multi-day analysis

Conclusion

For institutional traders, VWAP is not just a line on a chart—it’s a tactical benchmark, a liquidity compass, and a foundation for execution analytics. Whether embedded in algorithms or used for post-trade analysis, VWAP remains indispensable in navigating the fragmented, high-speed landscape of modern markets.