Combining Multiple Indicators Enhances Signal Precision and Execution Quality for Institutional Traders

Strategically combining technical indicators—such as trend, momentum, volatility, and liquidity metrics—can dramatically improve signal reliability, reduce false positives, and align trades with institutional execution logic. This article explores how professional traders integrate multiple indicators to build robust, high-conviction strategies.

Introduction: Why Indicator Confluence Matters

Single indicators offer limited perspective. For institutional desks managing large positions, signal confirmation across dimensions is essential. Combining indicators allows traders to:

-

Validate entries with trend + momentum + volatility alignment

-

Filter out noise from high-frequency price action

-

Structure trades with tighter risk and higher expectancy

Common Institutional Combinations

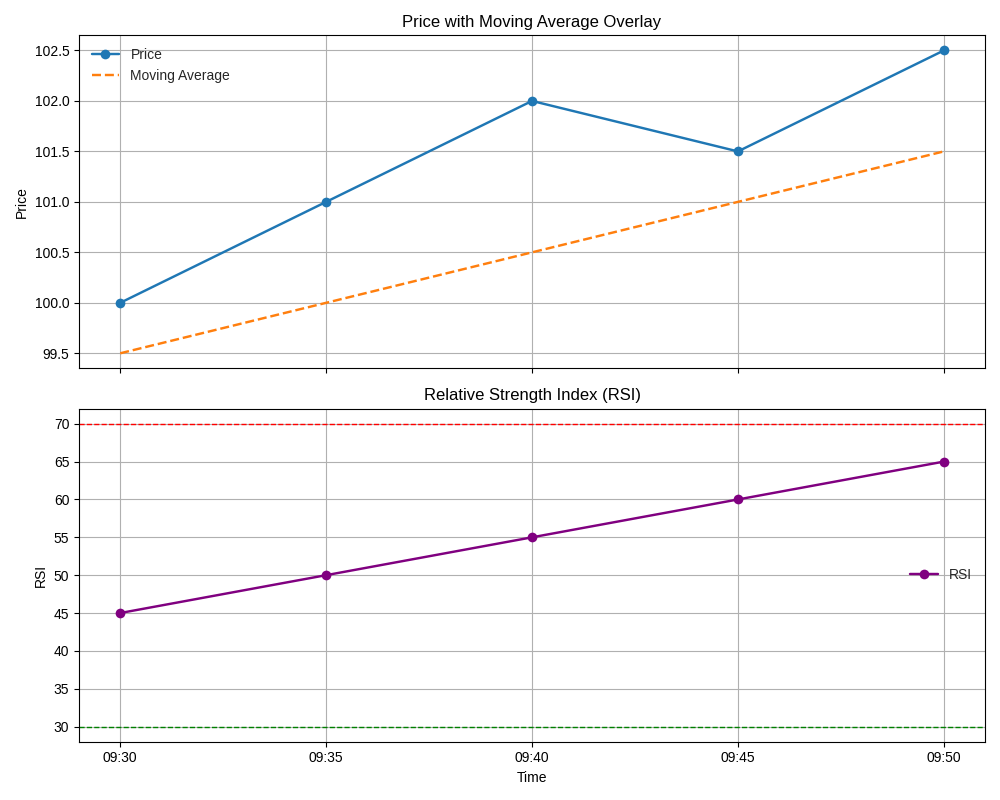

1. Moving Average + RSI

-

MA defines directional bias

-

RSI identifies exhaustion zones

-

Use case: Buy pullbacks in uptrend when RSI < 40

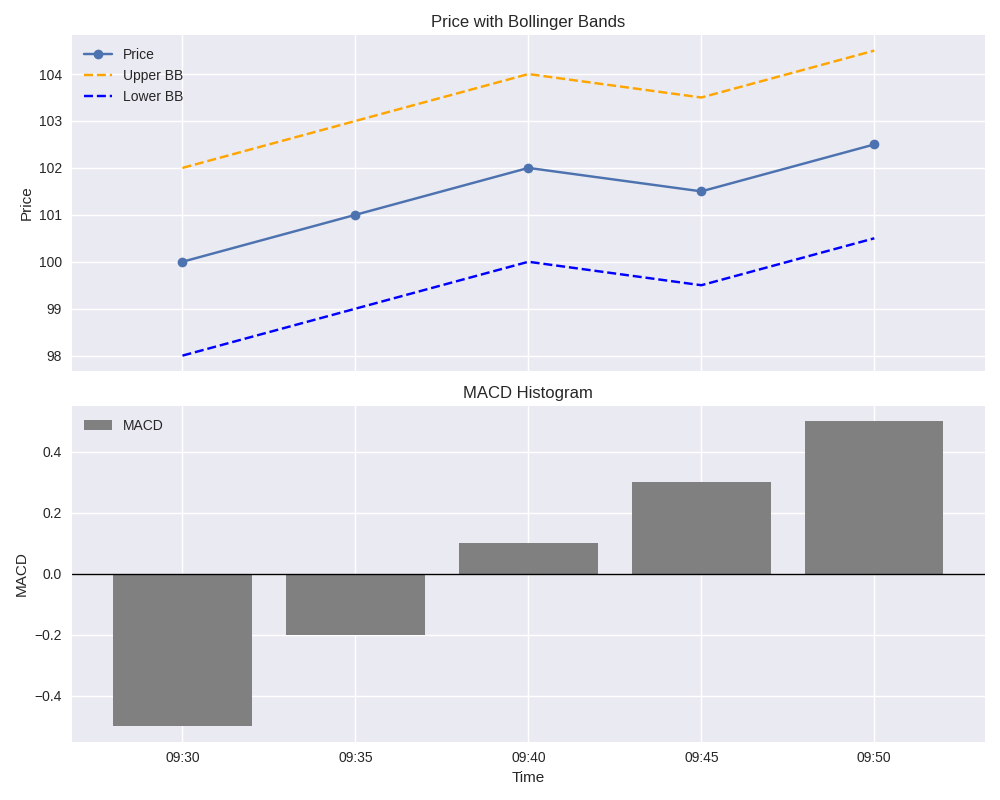

2. MACD + Bollinger Bands

-

MACD reveals momentum shifts

-

BB defines volatility envelopes

-

Use case: Enter long when price bounces off lower BB and MACD crosses above zero

3. VWAP + Order Flow

-

VWAP benchmarks fair value

-

Order Flow tracks aggressive buying/selling

-

Use case: Enter long near VWAP with buy imbalance

4. ATR + Volume

-

ATR measures volatility

-

Volume confirms conviction

-

Use case: Trade breakouts only when ATR is rising and volume spikes

Graphical Illustrations

Two graphs are included above:

-

Graph 1: Price with Moving Average overlay and RSI below. Entry zones occur when price touches MA and RSI rises from oversold.

-

Graph 2: Price with Bollinger Bands and MACD histogram. Confluence zones highlight bullish reversals.

Click/open the cards above to view the graphs.

Execution Strategy Integration

Institutional algorithms embed multi-indicator logic to:

-

Trigger orders only on multi-indicator confirmation

-

Adjust participation rate based on volatility and volume

-

Avoid execution during conflicting signals

Examples:

-

VWAP + Order Flow used in smart routing

-

ATR + Volume used in breakout algorithms

-

MA + RSI used in discretionary execution filters

Limitations and Considerations

-

Overfitting risk: Too many filters may reduce trade frequency

-

Lag: Indicators like MA and MACD may delay entries

-

Conflict: Indicators may give opposing signals in choppy markets

Conclusion

Combining indicators is a cornerstone of institutional precision. By aligning trend, momentum, volatility, and liquidity signals, traders build strategies that adapt to complex market regimes and optimize execution quality.